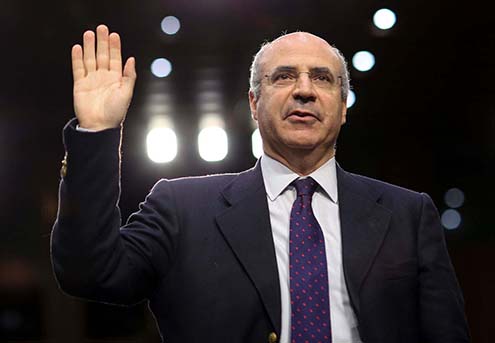

The Man Behind the Magnitsky Act: Did Bill Browder’s Tax Troubles in Russia Color Push for Sanctions?

100Reporters – Oct 20, 2017

The controversial New York meeting in June 2016 between Donald Trump’s campaign team and a group of Russians, initiated as a talk about finding dirt on Hillary Clinton, is drawing new scrutiny of US economic sanctions against targeted Russians.

At the meeting, Donald Trump Jr. and other Trump confederates, lured by a promise of compromising information on Trump’s rival, instead stumbled upon a quagmire: a fraud that bilked the Russian treasury of $230 million; a trans-Atlantic dispute over offshore accounts and tax evasion, and a U.S.-born investor, William Browder, who once ran the largest foreign investment fund in Russia, and who plays the eminence grise in this drama.

Browder is perhaps best known as an investor in Russia turned an anti-corruption activist, and the driving force behind the Magnitsky Act, the battery of economic sanctions aimed at Russian officials. However, an examination of Browder’s record in Russia and his testimony in court cases reveals contradictions with his statements to the public and Congress, and raises questions about his motives in attacking corruption in the Kremlin.

That human rights effort, named after a man Russian investigators say was part of a tax evasion scheme, has helped sour US-Russian relations.

by Browder’s Russian shell companies.

Browder has insisted that his departure from Russia resulted from his anti-corruption activities. However, Russian authorities revoked his visa in November 2005, two years after a provincial court convicted Browder of evading some $40 million in taxes. The Russian federal government next took up the case.

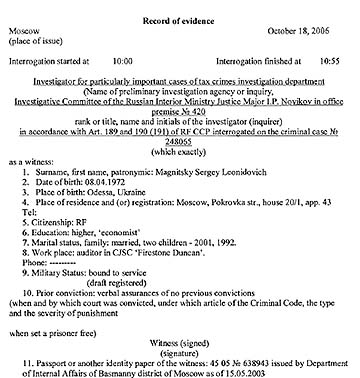

Magnitsky was interrogated in 2006 about the tax evasion and detained over it in 2008.

Nevertheless, by 2012 Browder had convinced key U.S. politicians that Magnitsky was his lawyer, hired to investigate the theft of three of Browder’s companies and jailed by corrupt Russian authorities, who engineered his death in prison. The Magnitsky Act banned visas and business ties for a number of Russians allegedly linked to Magnitsky’s death. The impact of that legislation has spread, with US and European human rights advocates pressing for a global Magnitsky Act against public officials and corporate officers everywhere accused of corruption or rights violations.

Back in the spotlight this summer, Browder used Magnitsky’s death to again rail against shady Russian government officials and their cronies in Congressional testimony and in the press.

It is the theft of the three companies that ties Browder to the controversial Trump, Jr. meeting. In 2007, shell companies that had once been owned by Browder were used to claim a $230 million tax refund based on trumped-up financial loses. Browder has said the companies were stolen from him, and indeed in a murky operation organized by a convicted fraudster, they were re-registered in the names of others.

Prevezon, photo by Lucy Komisar, Nov. 2016.

About five years later, Browder went after a company he said had gotten money laundered in the tax refund fraud. He persuaded the Justice Department to bring charges in 2013 in New York against Prevezon, a Russian real estate investment firm, and others. Browder accused Prevezon of receiving $1.9 million from the tax refund fraud. It used the money to buy New York real estate, he said.

That New York lawsuit is what brought Prevezon’s Russian lawyer, Nataliya Veselnitskaya, to the United States several times in 2016, including to the June 2016 meeting with Trump Jr.

Veselnitskaya says the Prevezon suit was a distraction Browder used to cover up his own tax evasion and–she claims–collusion in the tax refund fraud. She bases her accusation in part on the role of Magnitsky. She has lobbied against the Magnitsky Act, deriding it as Browder’s way of protecting himself from Russian legal trouble.

Browder declined repeated requests for an interview about the Russian charges, his time as an investor in Russia, and his campaigns for the Magnitsky Act. Browder went so far as to have the author of this article banned from a public talk he gave at the Institute for Advanced Studies in Princeton, New Jersey, in December 2016.

But this summer, in sworn testimony before the U.S. Senate’s Judiciary Committee, Browder made statements that appear to contradict his testimony in the Prevezon case. Statements by Browder in this article come from the printed record of his Senate testimony, and his various public appearances and writings.

A Nested Russian Tale

“While working in Moscow I learned that Russian oligarchs stole from shareholders, which included the fund I advised,” Browder told the Senators during the Washington, DC hearing this summer.

There is, however, a record that suggests Browder knew well more about suspicious transactions involving the companies he controlled. That record questions the prevalent depiction of Browder as an entrepreneur wronged by a rough-and-tumble Russian business community.

A 100Reporters investigation, published in 2014, illustrated how Russian titanium company, Avisma, in which Browder was an investor, used an Isle of Man shell company to “buy” titanium at fake low prices and sell it abroad at higher market prices, cheating both minority share-holders and Russian tax authorities. A lawsuit showed Browder knew that was the business plan.

would discover he built his company on the same smelly firm.

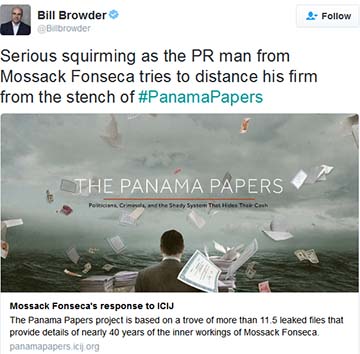

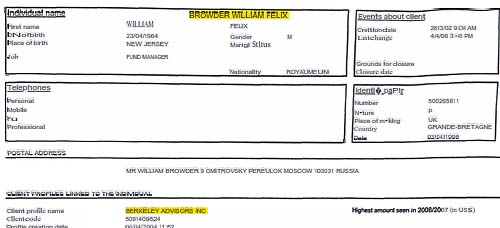

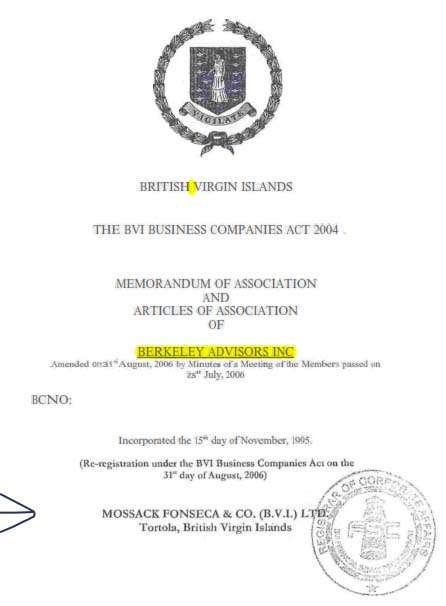

According to corporate documents, Browder’s holding company, Hermitage Capital Management, was built on corporate registrations authored by the Mossack Fonseca law firm.

See link for details.

That firm is the source of more than one million documents made public by the International Consortium of Investigative Journalists in its Panama Papers investigation, involving assets hidden through the use of shell companies and secret offshore accounts. Its disclosures have led to resignations by government officials worldwide, criminal investigations and charges of corruption against bureaucrats and business leaders.

Advisors shell company in the British Virgin Islands tax haven.

Mossack Fonseca set up two companies in the British Virgin Islands, Berkeley Advisors and Starcliff, to hold shares in Hermitage.

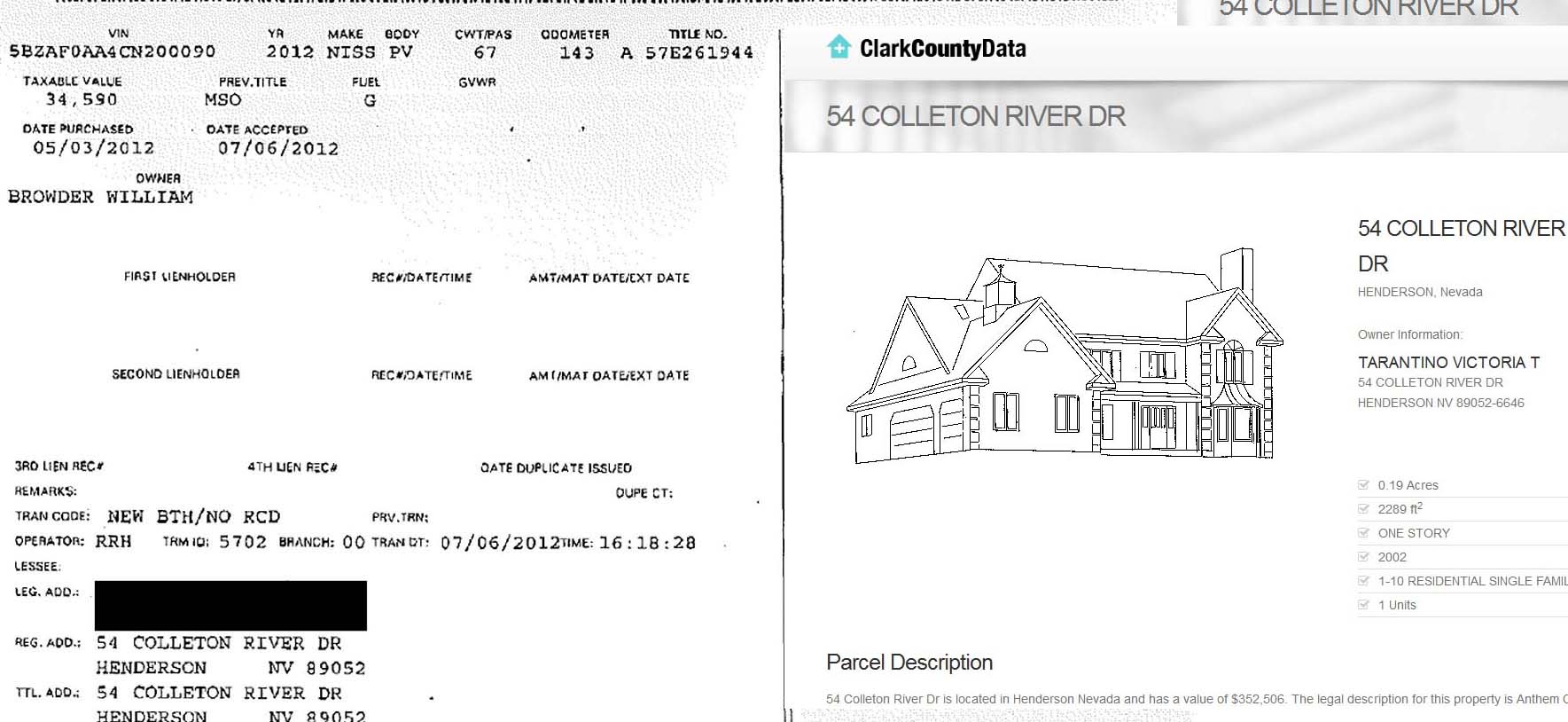

The Browder family home in Princeton, New Jersey, is registered by a Mossack Fonseca shell, Pepperdine Holdings Ltd.

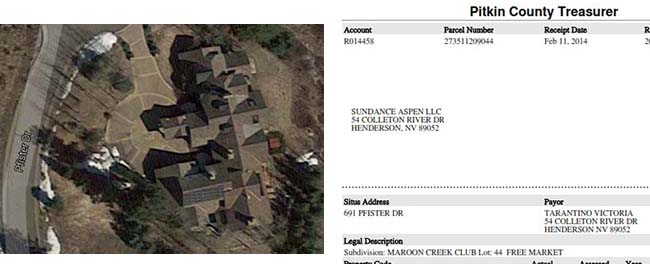

registered in name of shell company Sundance Aspen run by Victoria Tarantino.

Browder’s $11-million vacation home in Aspen is also “owned” by a shell registered in an agent’s name.

is the more modest house where his agent Victoria Tarantino lives.

The US taxes offshore earnings. In 1998, Browder traded his US citizenship for one in the UK, which does not.

How Hermitage Got Started

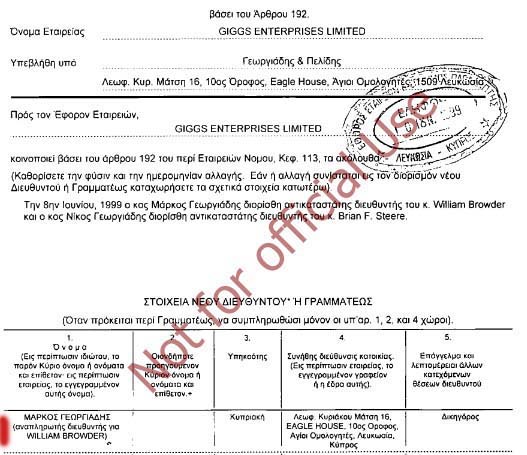

In Browder’s time in Russia, a key figure was accountant Konstantin Ponomarev, who in 1995 founded Firestone Duncan with American lawyer Jamison Firestone as a minority partner. Ponomarev hired Magnitsky, with whom he had studied at the Russian Economics Academy. He named Magnitsky deputy head of the new firm’s audit department and assigned him to Hermitage. According to Ponomarev, the firm – and Magnitsky — set up an offshore structure that Russian investigators would later say was used for tax evasion and illegal share purchases by Hermitage.

In a series of emails to the author, Ponomarev said that Firestone Duncan set up a number of Hermitage shell companies in the Russian republic of Kalmykia. They held stocks in some Russian companies that Browder had purchased for himself and clients. Ponomarev said the structure helped Browder execute tax-evasion and illegal share purchase schemes.

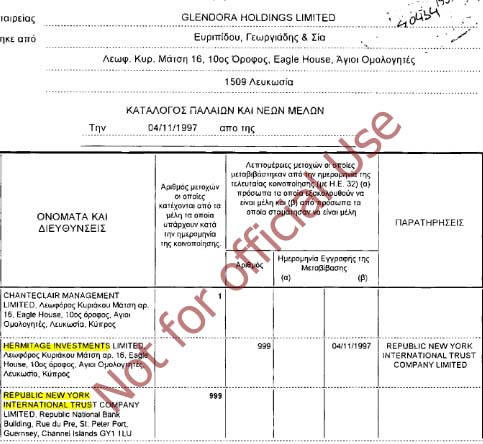

Edmond Safra, owner of Republic Bank, was an original Hermitage investor,

moving his funds through a Mossack Fonseca shell company.

He said the holdings were layered to conceal ownership: The companies were “owned” by Cyprus shells Glendora and Kone, which, in turn, were “owned” by an HSBC Private Bank Guernsey Ltd trust. Ponomarev said the real owner was Browder’s Hermitage Fund. He said the structure allowed money to move through Cyprus to Guernsey with little or no taxes paid along the way. Profits could get cashed out in Guernsey by investors of the Hermitage Fund and HSBC.

Browder is fighting Russia’s attempt to get Cyprus to

help trace how its shells laundered Hermitage Russian profits.

Russian authorities contend that Magnitsky was a participant in a tax fraud led by Browder.

Ponomarev said Hermitage wanted to obtain shares of Gazprom, the giant Russian energy conglomerate. Company policy and then Russian law prohibited direct purchases of Gazprom shares by foreigners, including foreign companies and investment funds. Foreigners could buy shares only through ADRs (American Depository Receipts) sold in London, but they could not buy them in such numbers – or at the same prices – as Russians could. Ponomarev said that in 1996, the firm developed for Browder “a strategy of how to buy Gazprom shares in the local market, which was restricted for foreign investors.”

It did the same for the Ziff brothers, then owners of Ziff Davis Media, whose investments Hermitage managed. Ziff Brothers Investments did not return repeated requests for comments.

Tax Breaks and Disabled Employees

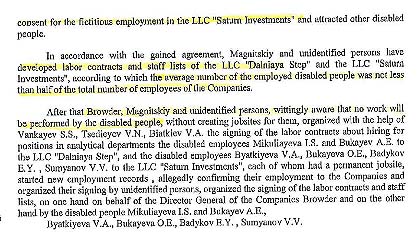

A central charge by Russian tax fraud investigators is that Hermitage’s shell companies falsely claimed they employed disabled workers and invested in the local economy. Ponomarev said the two claims would cut a company’s taxes by 40%.

He said, “After we successfully passed our own tax audit, we started to offer this to our clients, including Bill.”

In 2001, Hermitage shell companies Dalnaya Steppe and Saturn Invest declared on tax returns that a majority of their Kalmykian employees were disabled, complying with a law aimed at social rehabilitation of the disabled. But they hadn’t hired anyone, since they were just stock holding companies.

Russian tax authorities investigated the claim that disabled workers were “analysts” for the two companies. A legal judgement found that the employees were working at other locations as physical laborers. It said of the workers: “Bukayev has no education or qualifications. Badykov is a worker. Byatkiyev is a machine engineer. They had nothing to do with Saturn and were only used by the Claimant to get the income tax relief.”

The tax authority demanded overdue taxes plus a fine and interest. Russian court decisions show that Browder failed to pay, then later put the companies into bankruptcy. Back taxes could not be collected.

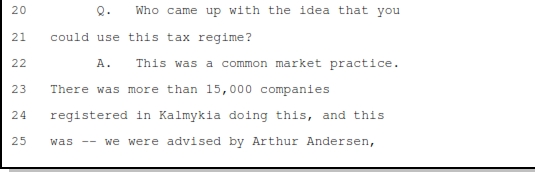

In a deposition he gave in the Prevezon case in 2015, Browder was asked, “Who came up with the idea that you could use this tax regime?”

“[W]e were advised by Arthur Andersen, Firestone Duncan, Ernst & Young and various other firms that this was a proper way of organizing our affairs,” Browder replied.

sold by his shell companies. “But the courts in Kalmykia didn’t agree with you, correct?”

Browder: “They did and they didn’t.”

An important point, Ponomarev said, was that other companies had lowered taxes this way, but had actually hired disabled workers.

The alleged tax frauds came to $40 million, Russian tax authorities charged. Allegedly illegal purchases of shares in Gazprom through the use of offshore shell companies were reportedly valued at another $30 million, bringing the total figure to $70 million.

In his Prevezon deposition, Browder said that in 2004 he “transferred (Dalnaya Steppe) to be liquidated” by Visao Risk Management Group (VRMG), a Moscow security firm run by Jakir Sha‘ashoua, whom Browder has identified as a former agent of the Mossad.

The Raid

that Congress and media never checked out.

On June 2, 2007, Russian tax investigators raided the offices of Hermitage and Firestone Duncan. They seized Hermitage company documents, computers and corporate stamps and seals.

In a statement to US Senators, Browder said that interior ministry officials “seized all the corporate documents connected to the investment holding companies of the funds that I advised. I didn’t know the purpose of these raids so I hired the smartest Russian lawyer I knew, a 35-year-old named Sergei Magnitsky. I asked Sergei to investigate the purpose of the raids and try to stop whatever illegal plans these officials had.”

Magnitsky, however, had been Browder’s Firestone Duncan accountant for a decade.

In questioning by Russian investigators in 2006, Magnitsky said he was an auditor on contract with Firestone Duncan. Though Browder continued to say Magnitsky was his lawyer in this summer’s testimony before the Senate Judiciary Committee, two years ago, in his testimony in the US government’s Prevezon case, Browder told a different story.

He was asked if Magnitsky had a law degree in Russia.

“I’m not aware that he did,” Browder said.

Did he know if Magnitsky “went to law school?”

“No,” Browder answered.

Creative Tax Refunds

All this leads to a second Russian investigation involving three Browder shell companies.

Browder told the Senate committee that Magnitsky “went out, investigated, and came back with an astounding conclusion. . . that the purpose of stealing our companies was to try to steal our assets, which they didn’t succeed in doing. However, they did succeed in stealing $230 million in taxes that we paid to the Russian government from the Russian government.”

The companies were re-registered in the names of straw men and used in fake lawsuits that demanded damages for alleged contract violations. Once the damages were paid, the companies filed for tax refunds that came to $230 million. Browder says that the companies’ documents taken when his firm and Firestone Duncan were raided were to enable the re-registration. He said that he received none of the funds.

refund scam, photo by Lucy Komisar, Feb 2017.

Moscow lawyer Andrey Pavlov in an interview in New York, told 100Reporters that he assisted in obtaining court orders based on the fake lawsuits claiming liabilities for the Hermitage companies that resulted in the $230 million tax refund fraud.

However, Pavlov contends that Browder knew the purpose of the raids on his company and on Firestone Duncan: authorities were looking for evidence to support Russian charges of tax evasion and illegal purchase of shares of Gazprom by his and the Ziffs’ companies. He disputes Browder’s contention that the tax investigators who did the raid were responsible for the Treasury scam.

Pavlov said the tax refund fraud he participated in was common in Russia at the time: firms agreed to settle claims from fake shell companies about bogus contract violations. The companies would then file amended tax returns to deduct the settlements, recouping money as tax refunds.

Pavlov said he was approached by Viktor Markelov, a convicted felon, who wanted to hire him. Markelov wanted Pavlov to obtain a court order based on an invented liability for the Hermitage companies, which would then lead to a claim for a tax refund. Pavlov said the refund application would require detailed information from the companies’ books for the year, which he said pointed to inside involvement. However, Pavlov said he was never told the identity of the client who would benefit from the refund scheme.

Pavlov was questioned by Russian authorities, and Markelov was convicted and sentenced to five years for the scam. At his trial, Markelov testified that one of the people he worked with to secure the fraudulent tax refund was Sergei Leonidovich. Magnitsky’s full name was Sergei Leonidovich Magnitsky.

“In October [2007] the whole Browder team knew about these claims and didn’t appeal the decision [allowing the take-over of his companies] which had been granted,” Pavlov said. “They did nothing till the money was paid out of the budget [the Russian Treasury].” This corresponds with Browder’s book, which states that he and Magnitsky found out about the theft of the companies in October 2007. Just the same, Browder didn’t immediately go to court to challenge the re-registration of the companies and the court’s decision.

However, it would appear that Browder knew, or should have known, about the theft months before. Financial documents for 2007-08 for HSBC Private Bank, which owned about 10 percent of Hermitage, state that as of July 27, 2007 Hermitage had set aside $7 million to cover legal expenses related to getting back Russian companies Hermitage owned. The document said others had taken control of the Hermitage companies to create fraudulent liabilities – and facilitate the fake lawsuit payouts. Deposed in the Prevezon case, Albert Dabbah, chief financial controller for HSBC, confirmed the document’s authenticity.

Magnitsky in Prison

Browder told the Senators, “On Nov 24, 2008, about six weeks after Sergei testified against a bunch of corrupt officials, some of the same officials he testified against, came to his home at eight in the morning in front of his wife and two children arrested him and put him in pre-trial detention where he was then tortured to get him to withdraw his testimony.”

But Magnitsky’s testimony in October 2008 does not mention any corrupt officials.

In his Senate testimony this summer, Browder said “they put [Magnitsky] in cells with 14 inmates and eight beds and left lights on 24 hours a day to impose sleep deprivation. They put him in cells with no heat and no window panes in December in Moscow so he nearly froze to death. They put him in cells with no toilet, just a hole on the floor where the sewage would bubble up. They moved him from cell to cell to cell in the middle of the night.”

A report by the Russian Public Oversight Commission for Human Rights Observance, which Browder links to on his website, does not echo all Browder’s charges, but confirms that prison conditions were bad for everyone, not Magnitsky alone. The group reported that one cell lacked a cold-water tap, and another hot water. On occasion, raw sewage spewed up from the in-ground toilet, covering the floor of Magnitsky’s cell. It took 35 hours for authorities to move Magnitsky and two cellmates. In important ways, Magnitsky did appear to suffer especially from harsh—and ultimately fatal—mistreatment. For six days, for example, Magnitsky had no access to boiled water, which worsened his already fragile health, the commission wrote. Despite documented need for ongoing medical attention, he was transferred to a prison where none was available.

In his written statement, Browder said Magnitsky wrote over 400 complaints detailing instances of mistreatment. “He was able to pass his hand-written complaints to his lawyers, who dutifully filed them with the Russian authorities. Although his complaints were either ignored or rejected, copies of them were retained. As a result, we have the most well-documented case of human rights abuse coming out of Russia in the last 35 years,” Browder wrote. The complaints were never made public.

In prison, Magnitsky turned to a fellow inmate, Oleg Lurie, for help in filing complaints about conditions. Lurie is a well-known Russian journalist who was accused of attempting to blackmail a member of the Duma, and later exonerated. Inmates often sought Lurie out for jailhouse advice. Deposed in the Prevezon case, Lurie described Magnitsky as initially “confident” that his employers were working to get him out.

But in a subsequent meeting, Lurie said, Magnitsky’s demeanor had changed. He was distraught, Lurie recalled, and said his employers were now selling him out and wanted him to sign testimony that had nothing to do with his charges. On October 13, 2009, Magnitsky filed a complaint accusing police of “possible participation” in the theft of the Hermitage companies.

Magnitsky died on November 16, 2009. Browder testified in the Senate that “eight riot guards with rubber batons beat him until he died.” He said elsewhere that the assault lasted eight hours. On a website devoted to Magnitsky, Browder posted the hospital death certificate, highlighting the notation, “closed craniocerebral injury?” But the report put a question mark after the finding, which wasn’t explained, and provided no evidence to indicate Magnitsky was beaten to death.

A 2011 analysis by the Physicians for Human Rights International Forensics Program of documents provided by Browder found no evidence he was beaten to death. However the analysis also described the conditions of Magnitsky’s imprisonment as “torturous,” and said that his lack of medical treatment was “calculated, deliberate and inhumane.” Conflicting and absent medical records undermined their confidence in the official determination of Magnitsky’s cause of death.

Meanwhile, in 2013, a Russian court, relying on investigations that included the testimony of Konstantin Ponomarev, convicted Browder of tax evasion. Browder was in London.

Though Browder claims Magnitsky was convicted, a Russian legal document shows the case against him was closed because he had died.

Two weeks ago, Kirill Nogotkov, a Russian bankruptcy receiver on the trail of assets that Browder transferred out of Dalnaya Steppe, won a case in Russia against HSBC bank, the Hermitage trustee. The bank paid $30 million of evaded taxes.

Additional documents have been added to the original 100Reporters post.

To watch the full 6+ hour Browder deposition on youtube, click here: One, Two, Three, Four, Five, Six

You didn’t read this in the MSM. And you won’t. Please donate to make such self-financed reporting possible!